TB-101 Income Reporting and Accounting Methods of Non-U.S. PPP Loan / Expense Treatment Under CBT & GIT (view Press Release) TB-102 - Net Operating Losses (NOLs) and Post Allocation Net Operating Losses (PNOLs) with Certain Mergers & Acquisitions Notice: 2020 Corporation Business Tax: Automatic Extension for Certain Filers TB-103 Initial Guidance on New Jersey's Conformity to IRC Section 1502 for Combined Returns TB-90(R) Tax Credits and Combined Returns NJ Tax Relief for Texas Winter Storm VictimsĢ020 Income Tax Filing Deadline Automatically Extended to May 17, 2021 TB-102(R) Net Operating Losses (NOLs) and Post Allocation Net Operating Losses (PNOLs) with Certain Mergers & Acquisitions TB-87(R) Initial Guidance for Corporation Business Tax Filers and the IRC § 163(j) Limitation

Notice: Short Period Returns in the Context of Combined Reporting

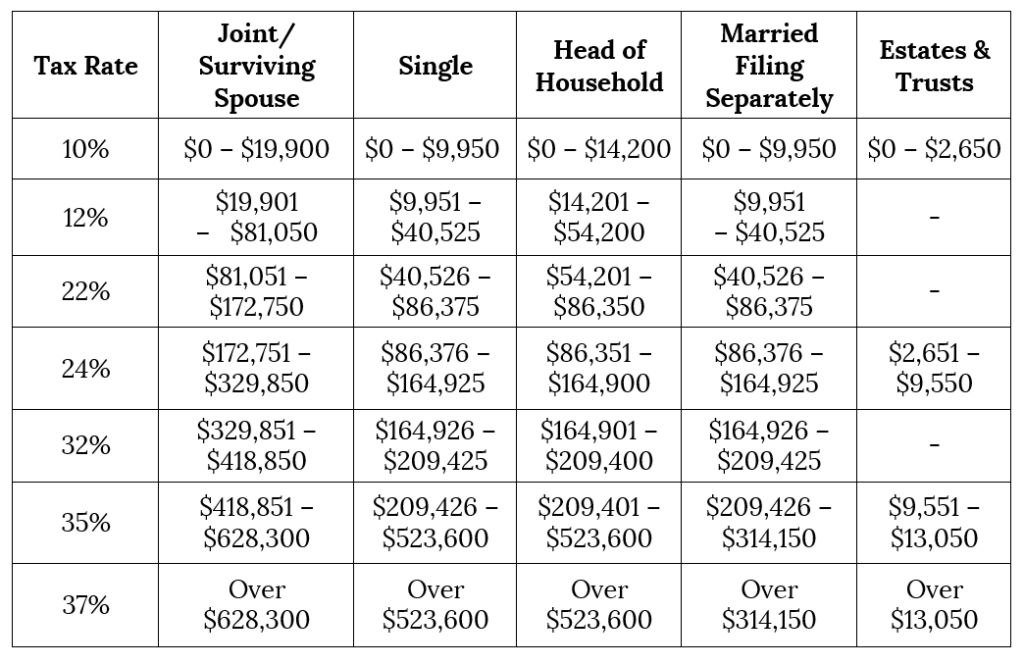

#Single tax brackets 2021 irs update

Notice: Update Regarding CBT Standardized Return for Certain Filers Teleworking – End of COVID-19 Temporary Suspension Period for Nexus and Withholding Purposes.Ĭorporation Business Tax - Combined Reporting Initiative TB-98(R) Federal Return and the Forms and Schedules to Include with the Corporation Business Tax Return Pursuant to P.L. Treasury Announces NJ Division of Taxation Extends Filing & Payment Deadlines for Tropical Storm Ida Victims New limitations on Urban Enterprise Zone Exemption Certificates New Jersey Extends 2021 Tax-Filing Deadline for Kentucky Tornado Victims TB-104 Recreational Cannabis and Licensed Cannabis Establishments Hurricane Ida tax relief extended to February 15 for part or all of six qualifying states. Treasury Launches New Automated Payroll Service to Simplify Filings for Employers Revised TAM-2015-1(R) Convertible Virtual CurrencyĪs Filing Season Kicks Off, Treasury Reminds Taxpayers that More Money is Available to More People Than Ever Before Under Expanded Earned Income Tax Credit Program Notice to Atlantic City Casino Hotels - Imposition of $2 per day Surcharge on Casino Room Rentals Revision to Division Policy on Combined Groups and PL 86 272 TB-100(R) The Combined Group as a Taxpayer under the Corporation Business Tax Act TB-86(R) - Included and Excluded Business Entities in a Combined Group and the Minimum Tax of a Taxpayer That is a Member of a Combined Group Notice: Sign Purchases and Installation Services Sales and Use Tax Effective October 1, 2022ĬBT Returns - Income Excluded Pursuant to a Tax Treaty Interest Rate Assessed on Tax Balances for 2022 Governor Murphy Announces Extended Deadline to File for New ANCHOR Property Tax Relief Program, Expands Eligibility to Certain Renters Governor Murphy Announces Extended Deadline for Renters and Homeowners to File for ANCHOR Property Tax Relief ProgramĬannabis: New Social Equity Excise Fee for 2023 Governor Murphy and Treasurer Muoio Highlight Historic Property Tax Relief for Nearly 1.7 Million New Jerseyans

TB-105 Corporation Business Tax and Gross Income Tax Guidance regarding S Corporations and Qualified Subchapter S SubsidiariesĪnswers to Frequently Asked Questions on the New Jersey S Corporation Procedural ChangesĬredits for Taxes Paid to Other Jurisdictions and Refunds of Other State Taxes Paid Union County Restaurant Operator Facing Up to Three Years in State PrisonīFC-1 Returns Being Replaced with Form CBT-100 Notice: Sales Tax Holiday for Certain Retail Sales Notice: Timing of New Jersey Qualified Research Expenditures 2023, c.96Ĭannabis Licensee Income Computation and Reporting for Corporation Business Tax and Gross Income Tax Purposes Pursuant to P.L. TB-107 Changes to Corporation Business Tax, Gross Income Tax, and Other Requirements from P.L.

0 kommentar(er)

0 kommentar(er)